Foreign resident capital gains withholding (FRCGW) applies to all vendors disposing or selling of property under contracts entered into from 1 July 2016.

FRCGW is different to the foreign person surcharge when purchasing a property but is often confused.

The withholding obligation applies to both Australian resident and foreign resident purchasers.

The FRCGW tax rate is currently set at 12.5% and applies to any real property disposals where the contract price is $750,000 or more.

The contract price is based on the market value, generally speaking the ATO will accept the value when it is negotiated at arm’s length. However, if the ATO can refuse to accept the contract price and request a separate valuation.

Vendors must provide the purchaser with one of the following prior to settlement:

- for Australian real property, a clearance certificate obtained from the Australian Taxation Office (ATO)

Australian resident vendors selling real property will need to obtain a clearance certificate from the ATO prior to settlement, to ensure you don’t incur the 12.5% non-final withholding

- for other asset types, a vendor declaration

the vendor may provide the purchaser with a vendor’s declaration to specify withholding isn’t required on the acquisition of the asset.

To avoid possible delays in your settlement, apply online for a clearance certificate at least 28 days before you require it. You can apply for a clearance certificate with the ATO.

Failure to provide a clearance certificate will result in the purchaser having to withhold 12.5% of the contract price so they this money can be paid to the ATO.

When the FRCGW rules apply

- An entity (the purchaser) becomes the owner of a capital gains tax (CGT) asset as a result of acquiring it from a vendor (or vendors) under one or more transactions.

- At least one of those vendors is a relevant foreign resident at the time at least one of the transactions is entered into.

- The CGT asset is a certain type of Australian property or an option or right to acquire such property.

- The purchaser acquires the CGT asset under a contract entered into on or after 1 July 2016.

- There are no exceptions.

While the objective of the rules is to assist in the collection of foreign residents’ CGT liabilities, the withholding tax will apply regardless of whether the vendor’s gain on the sale of the asset is subject to tax under the CGT regime or as ordinary income.

Asset types

The legislation applies to the following asset types:

- real property – taxable Australian real property with a market value of $750,000 or more

- vacant land, buildings, residential and commercial property

- mining, quarrying or prospecting rights where the material is situated in Australia

- a lease over real property in Australia if a lease premium has been paid for the grant of the lease

- other assets

- indirect Australian real property interests in Australian entities (that is, a membership interest of 10% or more in an entity whose underlying value is principally derived from Australian real property) – this includes shares in a company that owns land or a building erected on that land, where the ownership of the shares gives a right to occupy that land or building (that is, a company title interest in real property)

- options or rights to acquire any of the above asset types.

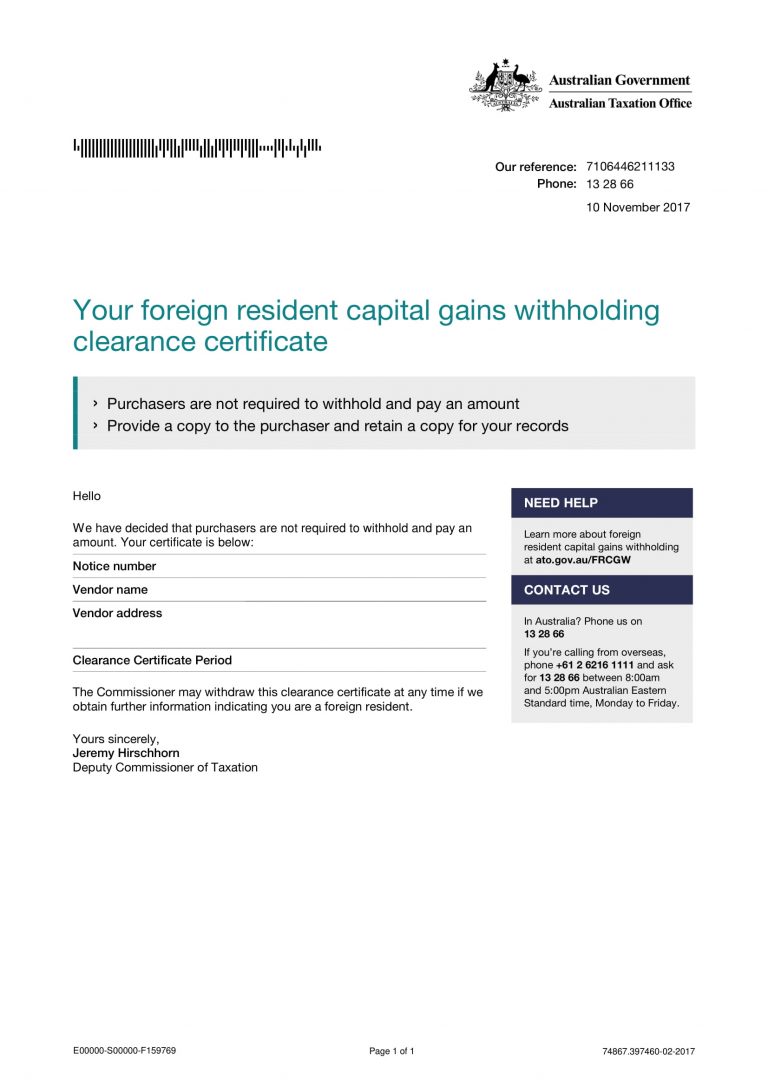

FRCGW Clearance Certificate

- You should apply for a clearance certificate online at least 28 days before you require it.

- Clearance certificates will be sent by email if an email address is provided in the application. Otherwise clearance certificates will be mailed to the vendor and the vendor’s contact using the addresses provided in the application.

- To avoid unanticipated delays, vendors seeking a clearance certificate should apply through the online system as early as practical in the sale process.

- A clearance certificate is valid for 12 months from the date of issue. It’s only valid for the listed vendor and clearance certificate period on the certificate.

- All parties on the Certificate of Title will require a clearance certificate. For example, joint tenants / tenants in common will need to fill out a form each. It is the vendor’s responsibility to provide the purchaser with the clearance certificate and ensure it’s valid.

- Vendors must ensure the details on their clearance certificate application are accurate, so the clearance certificate issues in the correct name as that shown on the Certificate of Title of the property.