Identifying and understanding easements in a property transaction is an important part of the conveyancing process. Vendors are required to disclose all easements affecting the land they propose to sell in a property contract, and buyers should ensure they are aware of the impact an easement will have on the land they are about the […]

Buying Property with Someone Else – Considerations for Property Co-owners

Buying a property with someone else is a great way to share the fun, stress, and cost of the venture. Often people buy a house with their significant other, to make a home or invest together. Others buy property with friends, relatives or business partners. Joining forces with someone else can increase your borrowing power, […]

First Home Buyers Choice NSW – stamp duty v land tax

For most people, buying their first home is a huge challenge, both financially and personally. With the cost of the “average” home in New South Wales exceeding a million dollars, saving a 20% deposit is itself a substantial undertaking, usually requiring years of sacrifice. The deposit is not the only amount that buyers in New […]

What is PEXA and how does it work?

If you are purchasing or selling a house in NSW is it likely that you have heard of the word PEXA. PEXA is an acronym for Property Exchange Australia. It is a public company with majority shareholders owned by Link, Commonwealth Bank and Morgan Stanley that completes around 20,000 settlements a week or 80% of […]

Things to know before buying into a Strata Scheme

A strata scheme is a building or collection of buildings that has been divided into ‘lots’. Lots can be individual units/apartments, townhouses or houses. When a person buys a lot, they own the individual lot and also share the ownership of common property with other lot owners. Common property generally includes things like gardens, external […]

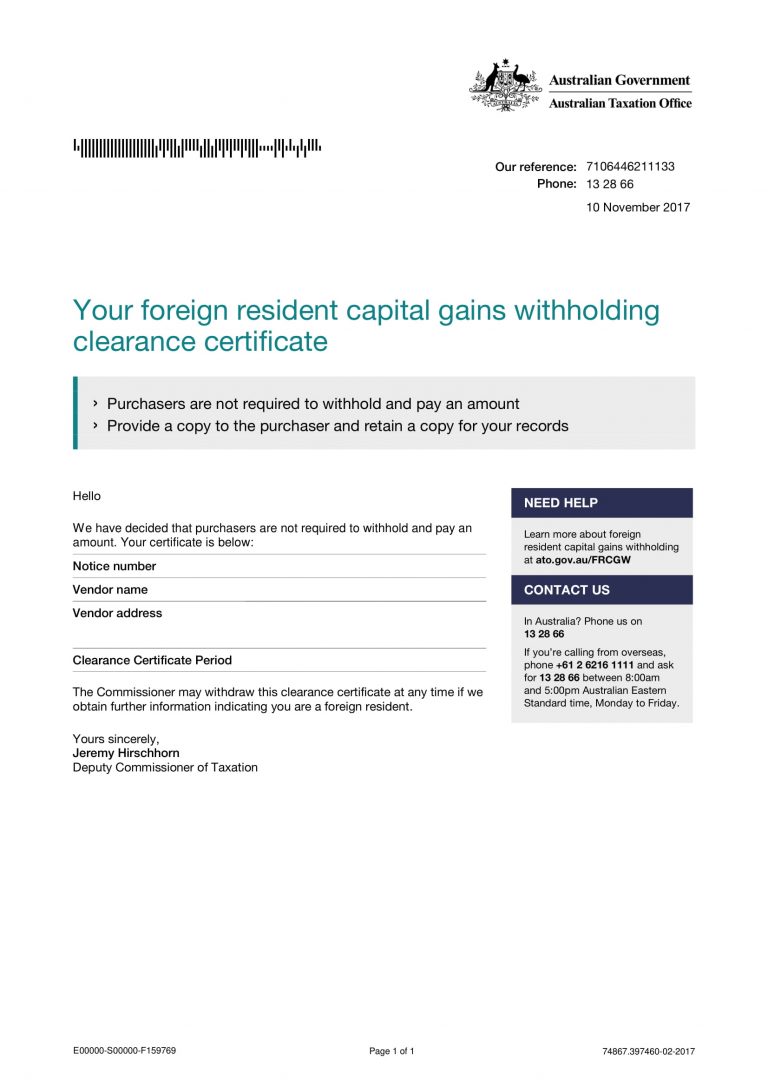

Foreign Resident Capital Gains Withholding FRCGW & Clearance Certificates

Foreign resident capital gains withholding (FRCGW) applies to all vendors disposing or selling of property under contracts entered into from 1 July 2016. FRCGW is different to the foreign person surcharge when purchasing a property but is often confused. The withholding obligation applies to both Australian resident and foreign resident purchasers. The FRCGW tax rate is […]